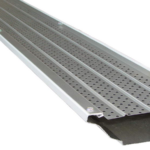

Are you in need of a new gutter system for your commercial property? If so, you’ve come to the right place! Here at Save Money & Time Gutters, we specialize in providing high-quality commercial gutter installation services that will save you both money and time in the long run.

A properly installed gutter system is crucial for protecting your commercial property from water damage. Gutters that are old, damaged, or improperly installed can cause a variety of problems, such as leaks, water damage to your foundation, and even flooding in your basement or crawl space.

Don’t take chances with your commercial property – call the experts at Save Money & Time Gutters today and let us provide you with the quality commercial gutter installation services you need and deserve! We look forward to serving you.

What is the 30 day rule to save money?

The 30 day rule is an age-old money saving technique that has been used by many people over the years. The basic idea behind it is that you put away money each day for 30 days, so at the end of the month you have a nice little nest egg saved up.

There are a few different ways to go about this. One popular method is to simply set aside a fixed amount of money each day, say $5. After 30 days, you would have saved up $150. Another option is to save a certain percentage of your daily income, say 10%. So if you make $50 per day, you would save $5 per day and after 30 days you would have saved $150.

The great thing about the 30 day rule is that it’s very flexible. You can adjust the amount of money you save each day based on your income and spending habits. If you find that you’re able to save more, you can increase the amount you put away. On the other hand, if you find that you’re struggling to save the fixed amount, you can lower it until it’s more manageable.

How to save up $10,000 in 3 months?

- Make a budget and track your spending. This will help you identify areas where you can cut back in order to save more.

- Automate your savings. Set up a direct deposit from your paycheck into your savings account so that you’re automatically putting away money each month.

- Cut back on non-essential expenses. This might mean eating out less, going out less often, or cutting back on other discretionary spending.

- Boost your income. If you can find ways to bring in a little extra money each month, it will help you reach your goal more quickly. This might mean picking up a side hustle or taking on some freelance work.

What is the best way to save money?

Saving money is a process that requires both patience and discipline. It is not something that can be achieved overnight, but rather is a journey that requires small steps and consistent effort.

Creating a budget is one of the most important things you can do when it comes to saving money. A budget allows you to track your spending and see where your money is going each month. This information is critical in helping you make informed decisions about your finances.

Setting Savings Goals is another key element of saving money effectively. By setting specific goals, you can better focus your efforts and make progress towards your objectives. Automating your finances is also a helpful way to save money. This can be done by setting up automatic transfers into your savings account or using a service like Mint to track your spending.

Saving money is an important process that requires both time and effort. By taking small steps and staying disciplined, you can make progress towards your financial goals. Creating a budget, setting Savings Goals, and automating your finances are all effective methods for saving money.

How can I save $1000 fast?

- Determine how much you need to save each month to reach your goal.

If you want to save $1000 in three months, you will need to save $333.33 per month. If you want to save $1000 in six months, you will need to save $166.67 per month.

Make a budget and stick to it.

In order to save money, you need to know where your money is going. Track your spending for one month to get an idea of where you can cut back. Once you have a budget, make a commitment to stick to it.

Automate your savings.

One of the best ways to ensure that you save money is to have the money automatically transferred from your checking account to your savings account. This way, you never even see the money and you are less likely to be tempted to spend it.

Make extra money.

If you want to save money fast, you need to find ways to make extra money. This can include picking up a part-time job, selling items you no longer need, or finding creative ways to make money.

Cut back on your expenses.

Look for ways to save money on your everyday expenses. This can include eating out less, cutting back on your grocery bill, and reducing your overall spending.

Have a goal in mind.

Is it good to save $20 a day?

Saving money is always a good idea, and $20 a day is a great goal to set. There are a few different ways to approach this. One is to set up a budget and make sure that you stick to it. This will help you to see where your money is going and where you can cut back. Another approach is to put your money into a savings account so that you can earn interest on it. This will help your money to grow over time. Whichever approach you choose, saving $20 a day is a great way to improve your financial situation.

How to save $1,000 dollars in 30 days?

- Evaluate your finances and create a budget: Before you can save money, you need to know how much money you have coming in and going out each month. Track your spending for a few days or weeks to get an idea of where your money goes, then create a budget that allocates funds for necessary expenses (such as housing, food, transportation, and healthcare) and leaves room for savings.

- Automate your savings: Once you have a budget in place, set up automatic transfers from your checking account to your savings account to ensure that you are saving regularly. If possible, try to save 10-15% of your income.

- Cut back on unnecessary expenses: Take a close look at your budget and see where you can cut back on spending, whether it’s eating out, shopping, or other non-essential expenses. Even small changes can add up to big savings over time.

- Boost your income: If your income is low, it may be difficult to save $1,000 in 30 days. If possible, consider ways to boost your income in the short-term, such as picking up some extra hours at work or taking on a side hustle.

How can I save 5000 dollars fast?

- One way to save money is to set a goal. Figure out how much you need to save and by when. This will help you stay on track.

- Finally, one other way to save money is to find ways to earn more money. This can include getting a side hustle or looking for promotions at work.

How to save $500 in 30 days?

If you are looking to save $500 in 30 days, there are a few things you can do. First, take a look at your budget and see where you can cut back on spending. Maybe you can cut back on going out to eat or shopping for new clothes. Instead, cook at home more and wear clothes you already have. Second, make a plan for your savings. Decide how much you will need to save each day or each week in order to reach your goal. Third, put your money into a savings account or a jar where you will not be tempted to spend it. Finally, make sure to stay disciplined and stick to your plan. If you can do all of these things, you will be on your way to saving $500 in 30 days.