Typically, rainwater damage is not covered by homeowners insurance. Homeowners insurance policies typically only cover damage caused by events that are out of the policyholder’s control, such as fires, theft, or severe weather. This means that if your home is damaged by rainwater, you will likely have to pay for the repairs yourself.

Does homeowners insurance cover water damage from rain in basement?

Most homeowner’s insurance policies will cover water damage that is the result of a burst pipe, overflowing toilet, or other plumbing issue. However, damage that is the result of heavy rains or flooding is typically excluded from coverage. So, if your basement has flooded as the result of a rainstorm, you will likely have to pay for the repairs out of your own pocket.

Does homeowners insurance cover roof leaks from rain?

Homeowners insurance typically covers roof leaks caused by rain, but there may be some exceptions depending on the specific policy. For example, if the roof leak is determined to be the result of negligence on the part of the homeowner, the insurance company may not cover the damages. In addition, some policies may have a deductible that must be met before the insurance company will pay out any benefits.

Does home insurance cover water damage from leaking pipe?

Home insurance typically covers water damage from leaking pipes, as long as the damage is not caused by a lack of maintenance on the homeowners part. For example, if a pipe bursts and causes water damage, the insurance will likely cover it. However, if the damage is caused by a slow leak that the homeowner did not fix, the insurance company may not cover it.

How do I make a successful water leak insurance claim?

- Make sure you have documentation of the leak. This can include photos, videos, or a written report from a professional.

- Be sure to contact your insurance company as soon as possible after the leak occurs.

- Follow the insurance company’s instructions on how to file a claim.

- Be prepared to provide supporting documentation, such as receipts for repairs or a plumber’s report.

- Keep track of all communication with your insurance company.

By following these tips, you can increase your chances of making a successful water leak insurance claim.

Why is my basement flooding when it rains?

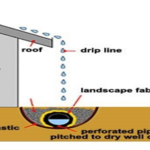

There are a few possible reasons for your basement flooding when it rains. One possibility is that your gutters are not properly diverting water away from your home. If your gutters are full of leaves and debris, they can cause water to back up and overflow into your basement. Another possibility is that your downspouts are not directing water far enough away from your home. Downspouts should be extended at least 10 feet away from your home to ensure that water is being properly diverted. Finally, if you have any cracks in your foundation, water can seep in and cause flooding. If you suspect any of these issues, you should call a professional to come and take a look.

Can you claim rain damage on insurance?

Most insurance policies have a clause that excludes coverage for damages caused by flooding. However, some policies will cover rain damage if the flooding is the result of heavy or prolonged rain that causes water to back up through your drains or seep in through cracks in your foundation. If you have rain damage and your policy excludes flooding, you may still be able to file a claim for damages caused by the heavy rain, but it will likely be denied.

What qualifies as water damage?

There is no one answer to this question as it depends on the circumstances and severity of the water damage. Generally speaking, water damage is any type of damage that is caused by water. This could include everything from a small leak to a major flood. Water damage can be very costly to repair, so it is important to be aware of the signs of water damage and to take action to prevent it if possible.

Why is water damage not covered by insurance?

Water damage is not covered by insurance because it is not considered to be a sudden and accidental event. Water damage is typically caused by a gradual leak or by condensation and is not something that is typically covered by homeowners insurance.

What to do when water comes in basement?

If you have water in your basement, the first thing you should do is assess the situation and figure out where the water is coming from. If the water is coming in from a specific area, such as a window well or cracks in the foundation, you can try to seal up the area to prevent any more water from coming in. If the water is coming in from the walls or floor, you may need to remove any affected materials, such as drywall or carpeting, to prevent further damage. Once you have stopped the water from coming in, you can start the process of drying out the basement. This includes opening up any windows and doors to allow for air circulation, setting up fans to help circulate the air, and using a dehumidifier to remove any moisture from the air. It is important to dry out the basement as soon as possible to prevent the growth of mold or mildew.

Bottom Line

No, rain water damage is not covered by homeowners insurance.