Is Leaffilter Tax Deductible?

When it comes to tax obligation reductions for LeafFilter, the response depends on which kind of insurance coverage you buy from your seller. The cost associated with buying, installing, and keeping LeafFilter seamless gutter security will not qualify as a valid expense under the IRS tax code and will certainly not be qualified for any kind of type of reduction. Furthermore, LeafFilter gutter guards are not taken into consideration an eligible home improvement expense by the Internal Revenue Service (IRS).

When LeafFilter is installed as component of a remodeling project or home renovation, it will likely qualify as a tax-deductible cost. When it comes to tax obligation reductions for LeafFilter, the answer depends on which type of coverage you buy from your merchant. Depending on what insurance coverage you get, it may be possible to subtract specific costs associated with LeafFilter installation and maintenance. The expense connected with buying, installing, and preserving LeafFilter gutter defense will not certify as a legitimate expense under the IRS tax obligation code and will certainly not be eligible for any type of kind of deduction. Additionally, LeafFilter rain gutter guards are not taken into consideration a qualified home renovation expenditure by the Internal Revenue Service (IRS).

Other Gutter Articles that May Interest You

-

Is Leaffilter Tax DeductibleIs there a class action lawsuit against LeafFilter? There is no current class action lawsuit against LeafFilter, however, there have been many complaints filed with the Better Business Bureau. Many of these complaints allege that LeafFilter is a scam and…

Is Leaffilter Tax Deductible?When it comes to home improvement projects such as installing the LeafFilter gutter protection system, many homeowners may be wondering whether the cost of installation is tax deductible. This article will provide an overview of LeafFilter and outline possible deductions,…

Is Leaf Filter Tax Deductible?Yes, in some cases Leaf Filter may be tax deductible. This would typically be the case if Leaf Filter was installed as part of a home improvement project that also included other deductible items such as a new roof or…

-

Are Home Gutters Tax Deductible?What types of home improvement are tax deductible? The most common type of home improvement that is tax deductible is energy efficient upgrades. These can include installing new windows, insulation, and HVAC systems, as well as upgrading to energy efficient…

-

Is Installing Gutters Tax Deductible?The answer to this question is a bit complicated. There are a few different factors that come into play when determining if something is tax deductible. The first thing to consider is whether or not the gutters are considered a…

Are Leaffilter Gutter Guards Any Good?

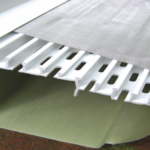

Gutter guards are dev...Are Leaffilter Gutter Guards Any Good? Gutter guards are developed to keep leaves and various other debris from clogging seamless gutters. There are a few types of seamless gutter guards, however the most popular and efficient seamless gutter guard is…

-

Is A New Roof Tax Deductible In Florida?If you're a homeowner in Florida, you may be able to deduct the cost of a new roof on your state income taxes. The amount of the deduction depends on the value of your home and the type of roof…

Who Owns Leaffilter Gutter ProtectionLeafFilter Gutter Protection is a company that specializes in manufacturing and selling gutter guards. The company was founded in 2005 by brothers Matt Kahl and Dave Kahl, who were looking for a way to protect their homes from the leaves…

-

What Is Leaffilter Rain Gutter ManagementLeafFilter is the largest gutter protection company in North America. They offer a micro mesh gutter protection system that is installed on your home’s existing gutters. The LeafFilter system keeps leaves, twigs, and other debris from clogging your gutters, which…

-

Who Makes Leaffilter Gutter GuardsLeafFilter Gutter Guard Systems are manufactured by LeafFilter North, Inc., a privately held company headquartered in Hudson, Ohio, United States. The company was founded in 2005 by brothers Matt Kahl and Mike Kahl. Is there a class action lawsuit against…

Who Makes Leaffilter Gutter GuardsLeaffilter North, Inc. is the company that manufactures LeafFilter Gutter Guards. This company is based out of Hudson, Ohio and has been in business since 2005. The company specializes in manufacturing gutter guards that keep leaves and debris out of…

Does Leaffilter Gutter Protection WorkYes, LeafFilter gutter protection does work. It is an effective way to keep your gutters clean and free of debris. The product is easy to install and is made of high quality materials. LeafFilter is a trusted brand and has…

-

Who Owns Leaffilter Gutter ProtectionLeafFilter is a gutter protection company founded in 2005. The company is headquartered in Hudson, Ohio and services homeowners in the United States and Canada. LeafFilter is a privately held company and is owned by its founders and employees. Who…

-

Are Leaffilter Gutter Guards Any Good?LeafFilter is one of the most popular brands of gutter guards, and for good reason. They are highly effective at keeping gutters clean and free of debris, and they are also very easy to install. In addition, LeafFilter offers a…

-

Where To Buy Leaffilter Gutter GuardsThere are a few places you can buy LeafFilter Gutter Guards. You can find them online at the LeafFilter website or at a number of other online retailers. You can also find them at some home improvement stores, though not…