Yes, in some cases Leaf Filter might be tax deductible. This would commonly be the case if Leaf Filter was installed as part of a home improvement task that also consisted of other insurance deductible things such as a brand-new roofing system or home windows. It’s constantly best to talk with a tax specialist to establish if Leaf Filter or any type of various other product is insurance deductible on your particular tax return.

What home enhancements are tax deductible 2022?

The solution may vary depending on the nation you reside in, however in the United States, the answer is that many home enhancements are not tax insurance deductible for the 2022 tax year. There are a couple of exceptions, nonetheless, such as energy-efficient appliances or office remodellings. For even more in-depth details, it is best to talk to a tax specialist.

What is the drawback of LeafFilter?

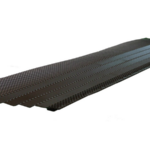

The most significant disadvantage of LeafFilter is the price. While it is not one of the most costly rain gutter defense system on the marketplace, it is also not the most affordable. Additionally, some customers have actually reported that the LeafFilter system does not always maintain seamless gutters as tidy as they would certainly like.

Is seamless gutter cleaning tax obligation insurance deductible?

The solution is perhaps. If you are an entrepreneur and you make use of the seamless gutter cleaning service to cleanse the rain gutters on your business home, after that you might have the ability to deduct the expense as an overhead. If you are a homeowner and you utilize a gutter cleaning solution to cleanse the rain gutters on your personal house, the cost is not tax deductible.

What energy-efficient enhancements are tax obligation deductible?

The government offers tax obligation breaks for a variety of energy-efficient home renovations. Several of the most usual consist of setting up energy-efficient windows, doors, and insulation. These improvements can conserve you money on your energy expenses and make your home much more comfortable.

Can I subtract a brand-new roofing on my taxes?

Yes, in many cases you can deduct the cost of a brand-new roofing system on your taxes. The roof covering has to be set up on a residential property that you have and utilize for organization or income-producing purposes, and it has to meet the demands of the Internal Revenue Service (IRS). The deduction is commonly taken as an expenditure on Schedule C of your federal income tax return.

What are required home enhancements that are tax-deductible?

The solution to this question relies on a variety of factors, including the nation in which you live, the sort of home you possess, and the objective of the enhancements. Nevertheless, there are a few general guidelines that can assist you establish which home improvements are tax-deductible.

In many cases, the costs of required repair services and maintenance are tax-deductible. This includes paint, repair work to the roofing system or structure, and taking care of any damage that has been caused by termites or various other pests.If you are

making renovations to your home in order to market it, then the expenses of those renovations are additionally tax-deductible. This is since the prices of these enhancements are thought about to be part of the price of selling the home.Finally, if you are

making improvements to your home for the objective of renting it out, the costs of those improvements are likewise tax-deductible. This is because the costs of these renovations are thought about to be part of the price of running a rental home. Is there a class action suit versus LeafFilter? Yes, there is a course action suit against LeafFilter.

The legal action was filed in October 2018, and alleges that LeafFilter engaged in deceptive and incorrect marketing, stopped working to reveal crucial information regarding its item, and stopped working to measure up to its pledges. The claim is currently pending in the United States District Court for the Southern District of New York.

Final Talk As you can see, there are a few things to think about when it concerns whether Leaf Filter is tax deductible. It truly relies on your specific situations. Nonetheless, it is most definitely something you must speak with your accounting professional or tax consultant about to get a definitive solution.

Yes, in some cases Leaf Filter may be tax insurance deductible. The response may vary depending on the nation you live in, but in the United States, the response is that the majority of home enhancements are not tax insurance deductible for the 2022 tax year. The federal government uses tax obligation breaks for a selection of energy-efficient home improvements. Yes, in a lot of instances you can deduct the expense of a brand-new roof on your taxes. As you can see, there are a couple of points to think about when it comes to whether or not Leaf Filter is tax obligation insurance deductible.