The answer to this question is unfortunately no. You cannot claim roof damage on taxes, as it is not considered a deductible expense. This is because roof damage is considered a maintenance expense, and maintenance expenses are not deductible.

Is there a tax credit for a new roof in 2022?

The answer is maybe. The Tax Cuts and Jobs Act eliminated the tax credit for energy efficient home improvements, which included roofs, but it is set to expire at the end of 2021. So, if you’re planning on getting a new roof in 2022, it’s worth checking with your tax professional to see if the credit has been reinstated.

What type of roof is tax-deductible?

A metal roof is one of the most energy-efficient and sustainable roofing options available. It is also one of the most tax-deductible roofing options, as it can save you money on your energy bills and help you qualify for government tax credits.

What kind of home repairs are tax-deductible?

If you’re a homeowner, you’re probably aware that there are a number of home repairs that are tax-deductible. These include repairs to your home’s foundation, roof, plumbing, and electrical systems. In addition, any repairs that are necessary to keep your home in good condition are also tax-deductible.

Is roof damage a casualty loss?

Yes, roof damage is considered a casualty loss. This is because roof damage is typically caused by an event that is out of your control, such as a severe storm. When this type of damage occurs, it is considered to be a loss of your property due to an external event, which makes it a casualty loss.

How do I know if my roof qualifies for tax credit?

- One of the first things you need to do is find out if your roof qualifies for tax credits. There are a few different ways to do this.

- One way is to contact your local government offices and ask about any tax credit programs that might be available for roof replacement. Another way is to ask your roofing contractor if they are aware of any tax credits that you might be eligible for.

- The most important thing to remember is that you need to have all the necessary documentation in order to qualify for any tax credits. This includes receipts, contracts, and any other paperwork that might be required.

- If you are unsure about whether or not your roof qualifies for tax credits, it is always best to consult with a tax professional. They will be able to help you determine if you are eligible and what you need to do in order to receive the credits.

Can I get a tax credit for my new roof?

You might be able to get a tax credit for your new roof, but it depends on a few factors. The first is whether your roof is considered energy efficient. If it is, you may be able to get a tax credit of up to $500. The second factor is whether you installed the roof yourself or had it done by a professional. If you did it yourself, you can’t get the tax credit. If you had it done by a professional, you might be able to get a tax credit of up to $1,000.

Who qualifies for the new tax credit?

The new tax credit is available to anyone who qualifies as a low- or middle-income earner. To qualify, your adjusted gross income must be below certain amounts: $50,000 for single filers, $75,000 for head-of-household filers, and $100,000 for married couples filing jointly. You also must have valid Social Security numbers for yourself, your spouse, and any dependents.

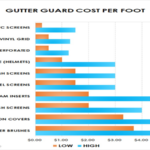

Are new gutters tax deductible?

While many home improvement projects are not tax deductible, installing new gutters may be an exception. According to the Internal Revenue Service (IRS), gutters and downspouts are considered part of your home’s “rainwater harvesting system.” This means that if you install new gutters, you may be able to deduct the cost on your taxes.

What is the residential energy credit for 2022?

For the 2022 tax year, the residential energy credit is worth up to $2,000 for qualifying energy-efficient improvements made to your primary residence. The credit is available for a wide range of energy-saving improvements, including solar systems, insulation, windows, doors, and more. To claim the credit, you’ll need to file IRS Form 5695 with your tax return.

Bottom Line

There’s no definitive answer to this question since it depends on a number of factors, including the extent of the damage and the tax laws in your particular jurisdiction. However, it’s generally advisable to consult with a tax professional to see if you can claim roof damage on your taxes.