Your homeowner’s insurance policy probably has language that excludes coverage for “gradual damage.” This is the insurance industry’s way of saying that they’re not going to pay for problems that occur over time, and that you should have been taking care of all along. So, if your gutters have been leaking for a while and have caused water damage to your home, your insurance company is likely to say that it’s your responsibility to pay for the repairs.

Does homeowners insurance cover roof leaks from rain?

Homeowners insurance typically does not cover roof leaks from rain. However, if the leak is caused by something else, such as a broken pipe, then it may be covered. It’s always best to check with your insurance provider to see what is and is not covered under your policy.

Does homeowners insurance cover leaky faucets?

Homeowners insurance typically covers accidental damages to your home, but not damages that occur due to lack of maintenance. So, if your faucet starts leaking because it hasn’t been properly maintained, your insurance policy is unlikely to cover the resulting damages.

Does homeowners insurance cover ice damage to gutters?

Homeowners insurance typically does not cover ice damage to gutters. This is because ice is considered a preventable hazard and it is the responsibility of the homeowner to take measures to prevent ice buildup on their gutters. Some homeowner policies may have an endorsement that will cover ice damage, but it is typically an optional coverage and will come at an additional cost.

Should I call my insurance company if my roof is leaking?

If your roof is leaking, you should call your insurance company as soon as possible. Your insurance company will be able to help you determine whether or not you need to file a claim and will be able to provide you with guidance on how to proceed.

Can I claim rain damage from home insurance?

Most home insurance policies cover water damage from rain, but there may be some exclusions or limits. For example, some policies may not cover flooding from heavy rains, or may only cover a certain amount of damage. To be sure, check your policy or contact your insurance agent or company.

How do I make a successful water leak insurance claim?

If you have suffered water damage in your home, you may be wondering how to make a successful water leak insurance claim. The first step is to take pictures or video of the damage and make a list of all the items that were damaged. Next, you will need to calculate the cost of repairs. Once you have all of this documentation, you can contact your insurance company to start the claims process.

The insurance company will likely send an adjuster to your home to assess the damage. They will also ask you questions about the incident and may request additional documentation. Be sure to cooperate with the insurance company and provide them with everything they need.

Once the insurance company has processed your claim, they will send you a check for the repairs. You can then use this money to fix the damage and get your home back to normal.

Making a water leak insurance claim can be stressful, but if you follow these steps, you should be able to get the compensation you need to repair your home.

Should I call a roofer or insurance first?

This is a difficult question to answer without knowing more about the situation. If there is damage to the roof that needs to be repaired, it is probably best to call a roofer. If the damage is covered by insurance, then it is probably best to call the insurance company first.

Why does my roof leak only during heavy rain?

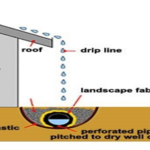

There are a few reasons that your roof might leak only during heavy rain. One possibility is that your gutters are clogged and not draining properly. When the rainwater has nowhere to go, it can back up under your shingles and cause a leak. Another possibility is that your roof is simply old and no longer able to adequately protect your home from the elements. If you’ve been experiencing persistent leaks, it’s time to call a roofing contractor to take a look and see what needs to be done to fix the problem.

Does homeowners cover roof storm damage?

While most homeowner’s insurance policies cover damage caused by storms, the amount of coverage may vary depending on the type of policy you have. For example, a policy with “all perils” coverage will typically provide more comprehensive protection than a “named perils” policy. In addition, the deductibles for storm damage can vary depending on the type of policy and the insurer. As a result, it’s important to review your policy documents and contact your insurer to determine the extent of your coverage.

How do you stop a roof leak while it’s raining?

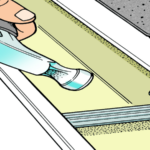

- It can be difficult to stop a roof leak while it is raining. However, if you have a tarp or some other type of cover, you can try to cover the leak with it. This will help to prevent water from getting inside and will also help to keep the area around the leak dry.

- Another option is to try to seal the leak with a sealant. This can be difficult to do if the leak is actively leaking, but it may be possible to seal it up if the leak is only small.

- If the leak is larger, you may need to call a professional to help you fix it. This is especially true if the leak is in a difficult to reach area.

- In some cases, it may be necessary to replace the entire roof. This is usually only necessary if the leak is severe or if it has caused damage to the structure of the roof.

Are water leaks covered by home warranty?

Water leaks are not typically covered under home warranty plans. This is because they are typically considered to be maintenance issues that are the responsibility of the homeowner. However, some home warranty plans may offer limited coverage for water leaks if they are the result of a covered appliance or plumbing fixture.

Bottom Line

If your gutters are leaking, it’s important to get them fixed as soon as possible. Not only can leaking gutters damage your home, but they can also lead to higher insurance premiums. While most insurance policies will cover damage caused by leaking gutters, it’s always best to check with your insurer to be sure.